FAYETTEVILLE, Ark. – Results from the 2010 Northwest Arkansas Omnibus Survey show that area residents are on firmer financial ground today than they were two years ago, and most residents think that their financial condition will either stay the same or improve over the next year. They also have favorable expectations about the performance of the U.S. economy in the coming year and think that now is a good time to buy a house.

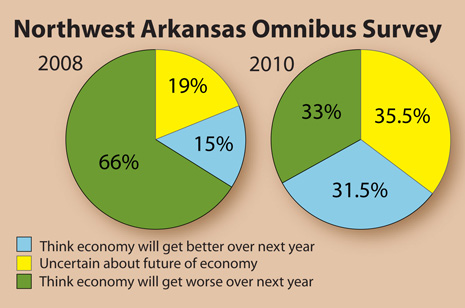

“This optimism contrasts starkly to results from two years ago,” said Molly Longstreth, director of the Survey Research Center at the University of Arkansas. “For example, in our 2008 survey, which we conducted in the months leading up to the banking and financial crises, two-thirds of area residents said they expected the U.S. economy to experience bad times over the next year. Only 15 percent expected good times. This year, though, only a third of area residents expect the U.S. economy to suffer, while almost as many expect it to experience good times.”

Questions in the survey are the same as those included in the Reuters/University of Michigan Index of Consumer Sentiment, a measure of consumer confidence in the economy at both the household and national level. The index is a standard by which economists, investors and policymakers predict future economic conditions, because they know consumer spending accounts for approximately two-thirds of U.S. economic activity. Longstreth said that U.S. residents as a whole and northwest Arkansans specifically are more optimistic about the economy than they were in 2008, although confidence levels have not yet rebounded to those seen in 2007.

As Longstreth mentioned, consumer confidence rose across the board. In 2008, nearly half of area residents said their financial well-being was worse than it was in 2007. This year, that figure decreased by 10 percentage points. Compared to the 2008 survey findings, more residents say they were either “better off” or “the same” financially.

Area residents are optimistic about their financial well-being in the year to come. Almost 90 percent believe their financial situation will improve or stay the same over the next year. Only 12.7 percent think they will be worse off. These results differ dramatically from those of 2008, when nearly a third of area residents thought their financial well-being would get worse over the coming year.

Results also differed from those of 2008 regarding attitudes about the national economy. This year’s survey showed that northwest Arkansans are nearly evenly divided among those who are uncertain (35.5 percent) about the national economy, and those who think it will experience good times (31.5 pecent) or bad times (33 percent). In contrast, 2008 results showed that 66 percent of area residents expected the U.S. economy to experience bad times over the next year. Only 15 percent thought the economy would get better, and the other 19 percent were uncertain.

Area residents are less optimistic in general about the performance of the national economy over the next five years, but they are more optimistic about the five-year prediction than they were in 2008. That year, 57 percent thought the U.S. economy would experience bad times over the next five years, while this year, 42 percent thought the same.

The 2010 survey also included questions about the housing market. More than 80 percent of area residents say that now is a good time to buy a house in northwest Arkansas, and 62 percent think that the average price of houses in the area will stay the same or decrease over the next year. The other 38 percent of area residents think house prices will rise.

These findings differ from the sentiments of Americans as a whole, as the percentages of northwest Arkansans who foresee housing prices increasing or remaining constant over the next year exceed those of Americans in general. So, in this sense, area residents’ expectations about housing prices over the next year are more optimistic than Americans as a whole.

Other findings paint a grim picture of the effects of the housing and financial crises. Slightly more than half of area residents know someone close to them who currently:

- has a house on the market but has been unable to sell it for 12 months or longer,

- has taken a house off the market in the past three months because it did not sell, and/or

- has filed for bankruptcy or experienced a foreclosure during the past three months.

Conducted each year since 2005, the Northwest Arkansas Omnibus Survey is a short, service-oriented poll to measure local residents’ perceptions about topics of local importance. In addition to questions gauging consumer sentiment, previous statewide and local omnibus surveys have included questions about gas prices, health care, emergency preparedness, education, the economy and the war in Iraq. More than 600 residents of Benton and Washington counties responded to this year’s survey.

The survey is done in both English and Spanish and uses random-digit dialing among both cellular and landline telephones to contact a wide sample of residents. Data are collected via a sophisticated, state-of-the-art, computer-assisted telephone interviewing system. Interviewers are highly trained, and information received during the process remains confidential. Longstreth said findings are accurate within a range of 4 percentage points.

Established in 1998, the UA Survey Research Center conducts surveys and evaluations for a variety of organizations and is dedicated to providing high-quality, nonbiased information. For more information on the center and its research, go to the Survey Research Center’s Web site

A copy of the 2010 Northwest Arkansas Omnibus Survey is available upon request.

Contacts

Molly Longstreth, director

University of Arkansas Survey Research Center

479-575-4222, mlongstr@uark.edu

Matt McGowan, science and research communications officer

University Relations

479-575-4246,

dmcgowa@uark.edu